28+ Third federal mortgage rates

And doesnt provide any products services or content at this third-party site or app except for products and services that explicitly carry. The maximum ANNUAL PERCENTAGE RATE that can apply is 18.

How Much Can You Afford For 1500 Month Mortgage Rates 30 Year Mortgage Current Mortgage Rates

If down payment is less than 20 mortgage insurance may be needed on the.

. Mortgage rates rose again as markets continue to manage the prospect of more aggressive monetary policy due to elevated inflation. The rate cannot increase or decrease more than 1 percentage point at each adjustment. Mortgage rates are determined by the amount borrowed and personal finances like credit history loan terms and down payment combined with greater economic factors like the federal reserve.

1 APR Annual Percentage Rate. The amortization term for Adjustable Rate Mortgage ARM programs is 15 or 30 years. Not only are mortgage rates rising but the dispersion of rates has increased suggesting that borrowers can meaningfully benefit from shopping around for a better rate.

The conforming loan limit is 650000. Your tax bracket depends on your taxable income and your filing status. The higher rate environment means housing affordability already a challenge in Californias high-priced real.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Mortgage Loan Type Term Interest Rate APR as low as. 2020 is expected to be a record year for mortgage originations with Fannie Mae predicting 41 trillion in originations and.

Loans on investment properties condos and second homes are also available. The Federal Reserves monetary policy and the price of US. 10 12 22 24 32 35 and 37.

30 2017 in a continuing attempt to streamline its ever-growing and inefficient system of funding college education. The Federal Reserve Bank of New York works to promote sound and well-functioning financial systems and markets through its provision of industry and payment services advancement of infrastructure reform in key markets and training and educational support to. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually.

To find the best mortgage rates we analyzed all 30-year loans from the biggest lenders in 2021 the most recent data available. 228 Adjustable-Rate Mortgage 228 ARM A 228 adjustable-rate mortgage 228 ARM maintains a low fixed interest rate for a two-year period after which the rate floats semiannually. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. When the rate. As the Federal Reserve bought Treasury bonds and mortgage-backed securities while the economy cooled mortgage rates fell to new record lows.

Over the last year interest rates have dropped from 21 to 09 a 65 decrease. The APR will be based on the prime rate plus a margin of 35 for Visa Equity Choice and 30 for Visa Equity Premier minimum 775. For instance if you take a 51 ARM the rate starts off low and you pay the same mortgage payments for the first five years.

The federal government discontinued the Perkins Loan Program on Sept. Mortgage rates climbed above 5 again after dipping below that threshold for the first time in months a week earlier. 2 Rates shown as low as.

Our research indicates that borrowers could save an average. 12 The companies with the lowest mortgage rates on average are. Rates shown are for a credit score of 740 or better purchase one unit owner-occupied property on a 45 day lock based on an 80 or less loan to value ratio.

Indicated by 10-Year Treasury Yields a prime mover of interest rates As of September 28 2020 Source. Rates subject to change. PCFCU is not responsible for the content or links to.

There are seven tax brackets for most ordinary income for the 2021 tax year. The end of the Perkins Loans a need-based program aimed at students from low-income families came despite calls from both Democrat and Republican senators to. Provident Bank offers biweekly mortgage loans for 1-4 family home purchases and refinances.

This means higher mortgage payments once interest rates increase. Rates are now below 1945 levelsand well under 61 the average US. Interest rate over the last 58 years.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Your rate may be different. For properties located in New York State borrowers are subject to a mortgage tax fee of 125 of loan amount.

Weekly Rate Recap Mortgage Rates Today. After hitting record lows in 2021 mortgage rates have risen sharply in 2022. Mortgage rates on 51 ARMs are often lower than rates on 30-year fixed loans.

The home appraisal is completed by a third party to give an unbiased opinion of how much the home is worth. The average mortgage interest rates increased for all three loan types week over week 30-year fixed rates went up 566 to 589 as did 15-year fixed rates 498 to 516 and 51 ARM rates 451 to 464. The number of mortgage applications decreased 08 as reported by Mortgage Bankers.

Treasury bond yields can influence whether mortgage rates go up or down. On the week of November 5th the average 30-year fixed-rate fell to 278. ARMs usually come in 31 ARM 51 ARM or 101 ARM.

We provide low down payment options. The present Prime Rate of 550 is current as of July 28 2022. The biweekly loan is a fixed rate loan with payments made every two weeks.

While the volatility in mortgage rates remains there are signs that the.

Ex 99 1

Ex 99 1

0q1p4lfgrxvehm

Ex 99 1

Ex 99 1

Ex 99 1

0q1p4lfgrxvehm

8 Awesome Navy Federal Credit Card Invitation Loan Interest Rates Loan Rates No Credit Loans

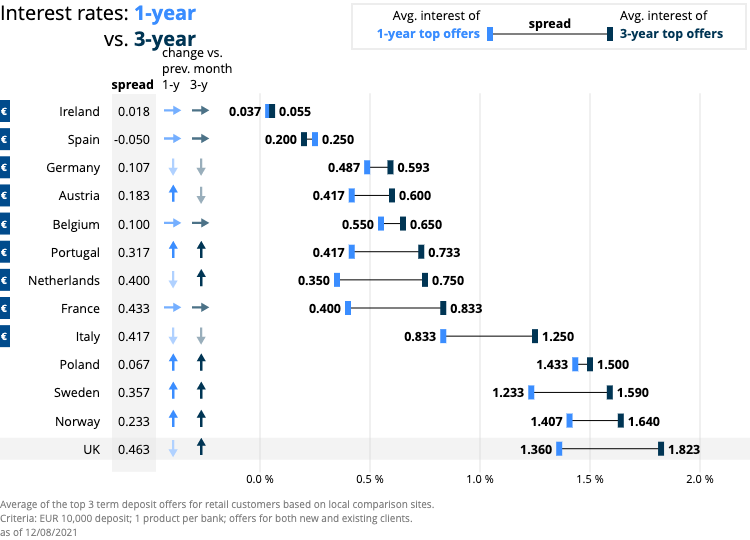

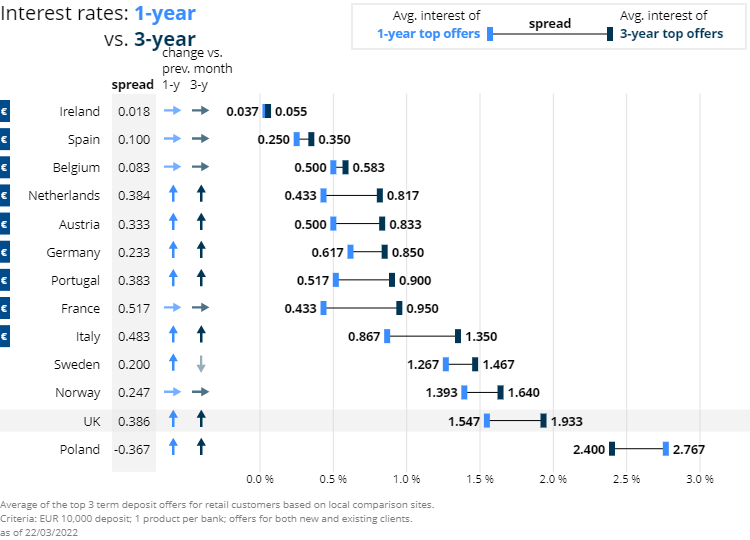

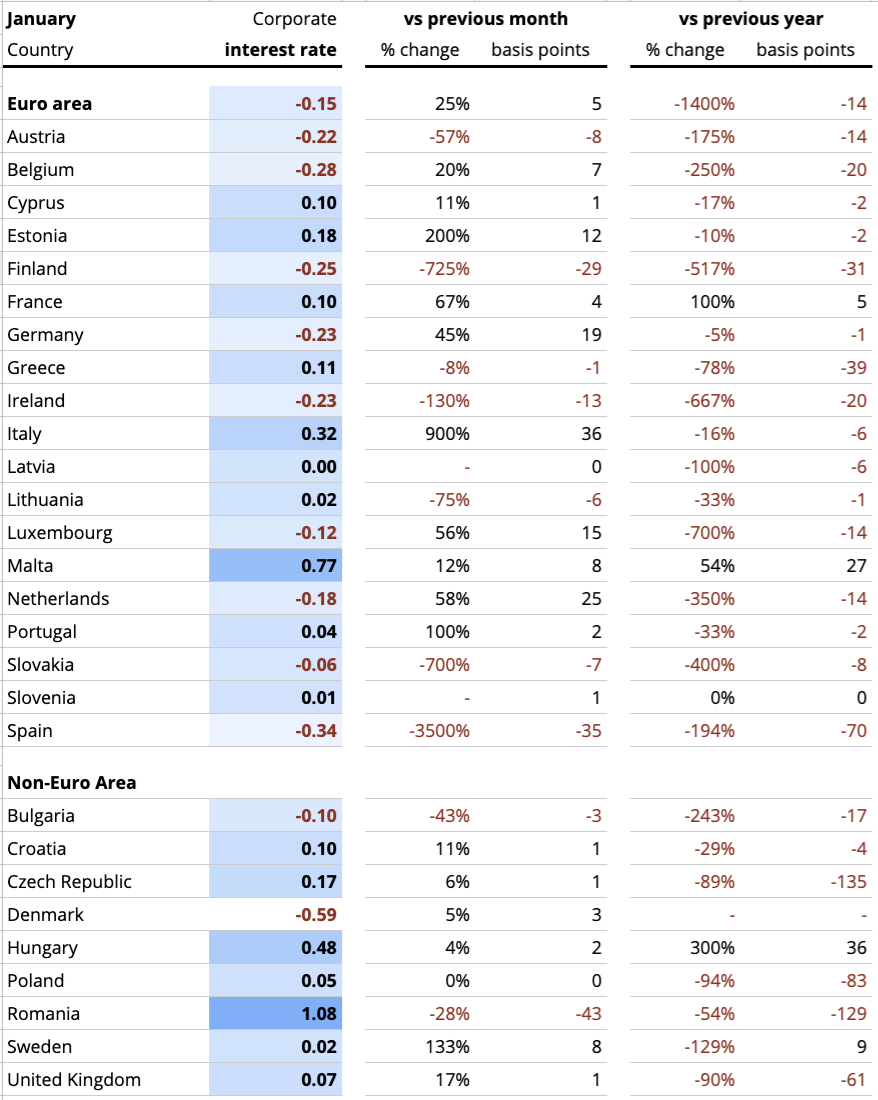

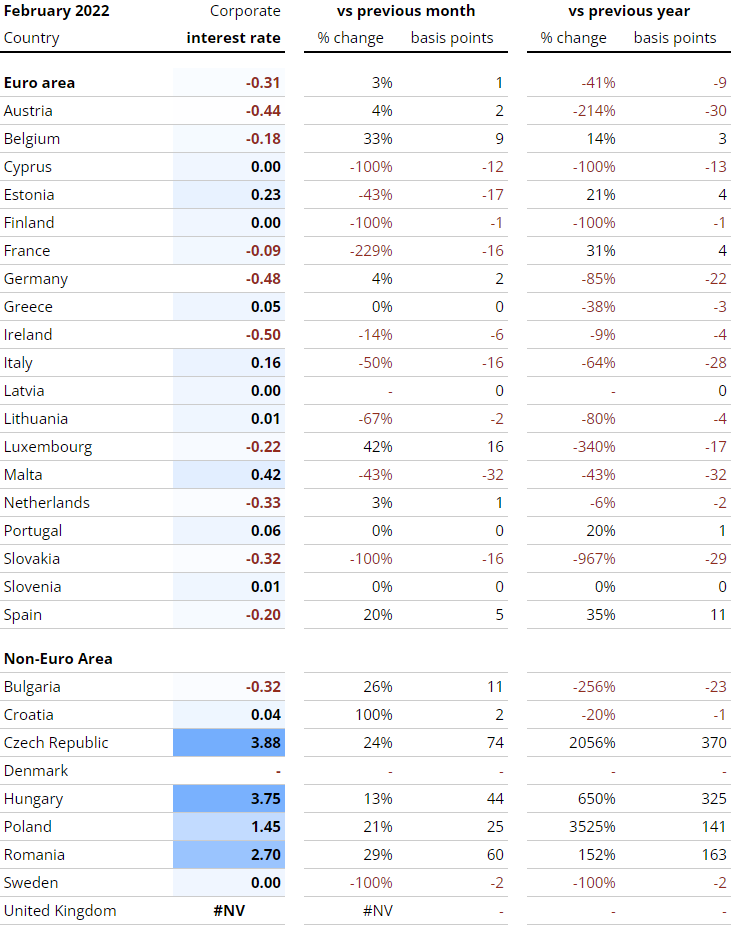

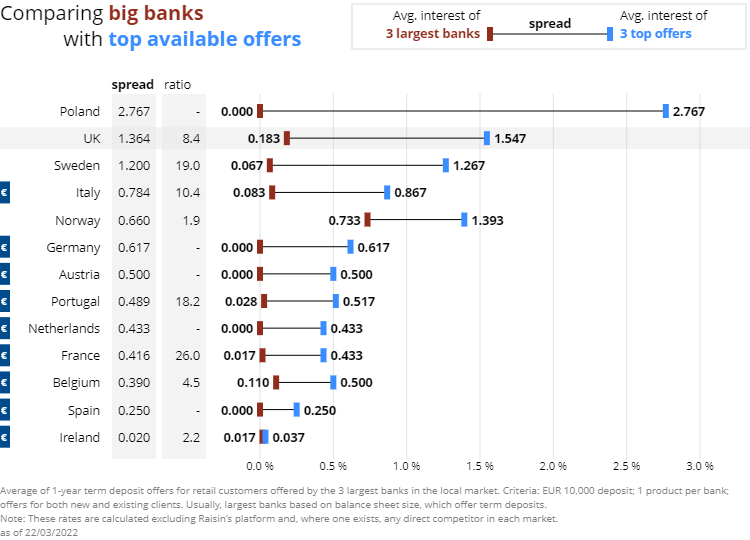

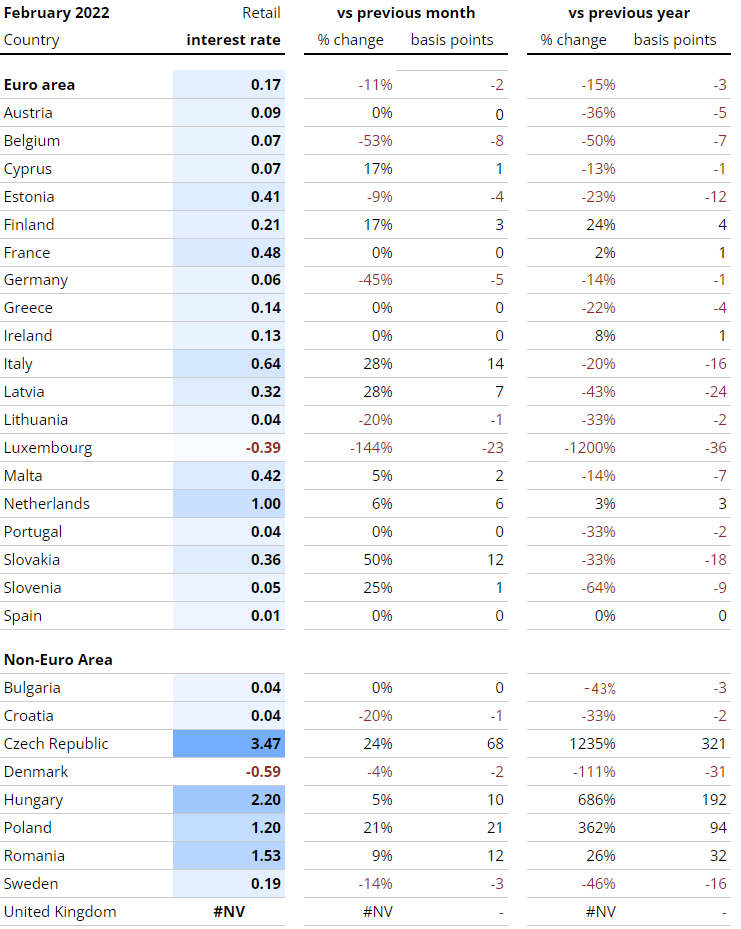

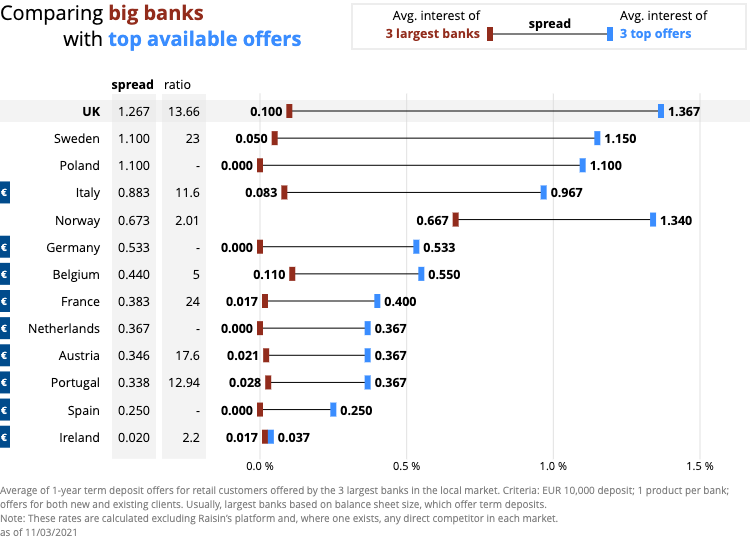

Interest Rates Explained By Raisin

Why Should You Buy Cars That Are A Couple Of Years Old Instead Of New Cars From A Financial Point Of View Quora

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

Interest Rates Explained By Raisin

1